By Shay Simkin, Global Head of Cyber at Howden

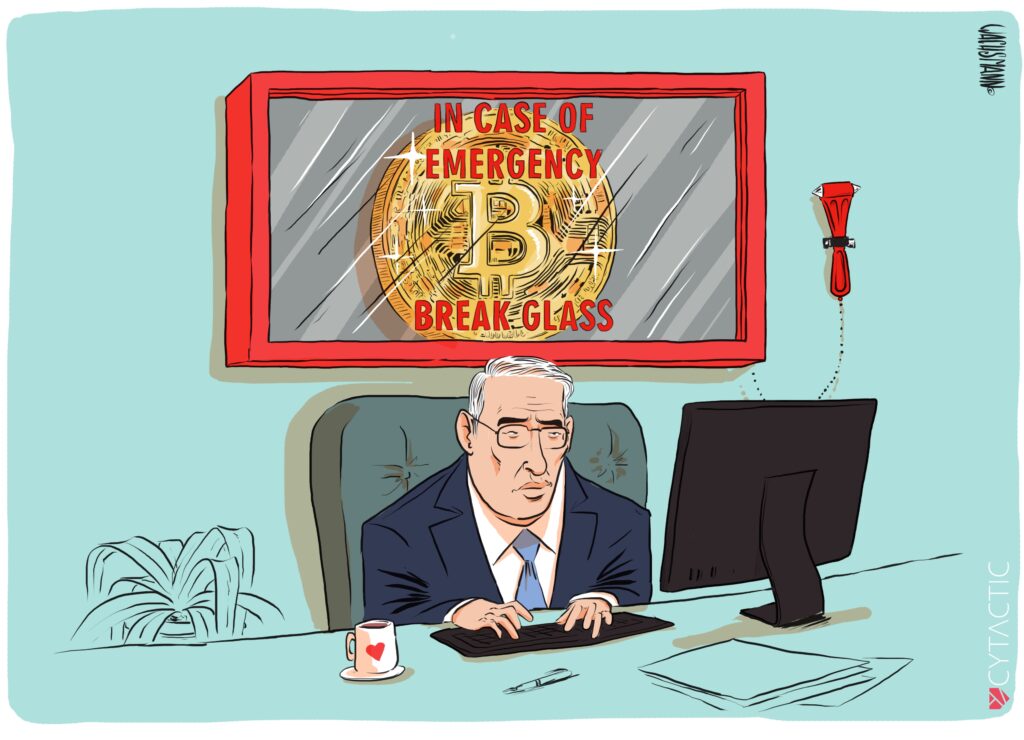

When a cyber crisis takes place, one of the first calls the targeted business makes is to their insurance company or broker. Picture a lawyer heading her small family legal firm, who one morning fires up her work computer and the screen displays a bright red ransomware alert: “Send $5m in Bitcoin to this address or you’ll never see your files again.” $5m is a lot of money for a firm that size, but the alternative is to halt the practice – ironically, it’s her awareness of cyber threats that led her to avoid backups of her clients’ sensitive documents. Her only viable outlet is to pay up and claim the ransom from her cyber insurance provider.

At Howden we deal with thousands of cyber crises every year, with businesses of all sizes and sectors targeted. Some are highly technologically oriented, while others are merely end-users of computers, software, and networks – but are just as susceptible to cyber attacks, if not more so, as they aren’t as savvy when it comes to cybersecurity.

We’ve seen double and triple extortion, we’ve seen mob methods, like threats against CEOs – “We have a photo of your children going to school. If you don’t pay, we will come to your house.” It’s not a couple of guys sitting in a garage, eating pizza and attacking. These are organised groups, these sophisticated criminals, graduates of the best universities in the world in their fields, who are currently employed by attack groups, and one needs to prepare for this.

100 million people were affected by single point of failure cyber attacks in ‘24, and cyber incidents were named as the most important risk by a 36% majority of Allianz survey participants in ‘24. Fittingly, cybersecurity solutions are in a rising demand, insurance included. Cyber insurance is currently a $15B-a-year business, and we predict it’ll grow to $50 billion by 2030. The rise in cybersecurity insurance premiums stems from the increase in the volume, sophistication, and cost of cyber attacks.

Cyber crises are chaotic, messy, complicated, multidisciplinary, dangerous for the company, and stressful for the crisis manager – it may very well be their single worst day. Prevention, preparedness and protection are critical layers of defence in such a heightened threat environment. Improved risk management not only makes organisations more resilient to ransomware and other financially motivated cyber attacks, but it also means that they are better equipped to navigate a highly volatile geopolitical climate that increases the potential for larger-scale incidents.

For this reason, Howden made a strategic decision to join forces with Cytactic to provide our clients with its innovative, cutting-edge cyber crisis management & readiness platform, ensuring they’re prepared and trained to mitigate damages and maintain business continuity during a crisis.

Howden policyholders can now onboard Cytactic and proactively prepare for and mitigate cyber incidents based on their threat model. Brokers get central positioning in crisis management rather than reacting in chaos. With command & control tools, real-time data, dynamic operational playbooks and AI assistance, this partnership sets a new industry benchmark for the insured’s cyber resilience.

Even though it’s a win-win for both sides, this shift is not without challenges. Not all companies are technologically oriented enough to understand the underpinning of cyber crisis management. But it’s easy to understand that when you’re in a crisis, you need the best people using the most advanced tools, optimising decision making, with all data flowing in real-time and available online to all involved parties, where everybody knows and is trained in their role.

Most importantly, readiness must be achieved long before the incident occurs. And this concerns businesses of all sectors and sizes. No one is safe, but anyone can be prepared. We believe it is important to take a proactive approach, and use the best innovative tools available to help their clients stand up to cyber crises and come out the victor, not a victim.

This is part of our duty and we must do everything to set a new standard in cyber crisis readiness and management.